Integration Details

- Home

- Integration Details

Why this integration matters:

This integration is designed to save you time, reduce financial errors and give you complete control over your personal or business finances. Whether you’re running a small business or keeping track of personal expenses, it ensures everything you need for smart financial management.

Key features of the integration:

Integration Feature means any Service feature that collects metrics by means other than through an OSCI, has an interface for displaying information collected via an OSCI that is separate from the Service’s or exports metrics to other Google or third party products or services.

- Real-Time Syncing of Transactions: With this integration, transactions from your bank accounts, credit cards, and other financial platforms are automatically synced into your finance software. No more manual entries—just real-time, accurate data at your fingertips.

- Unified Dashboard: View all your financial data in one place. Whether it's business expenses, personal spending, or savings goals, this integration provides a consolidated view of your finances for better decision-making.

- Automated Invoicing & Payments: Generate and send invoices effortlessly, and track payments automatically. The integration allows you to monitor cash flow, ensuring you never miss a payment or invoice.

- Expense Categorization: Transactions are automatically categorized based on spending patterns, saving you time and improving accuracy in budget tracking and expense management.

- Custom Reports & Analytics: Generate comprehensive reports on spending, income, and savings goals. The integration also provides insights into financial trends, enabling smarter budgeting and investment decisions.

How it works:

This software should have a user-friendly interface, and present data in an understandable visual format, be super secure, flexible, and customizable, integrate with payment systems and banks, and offer 24/7 customer support.

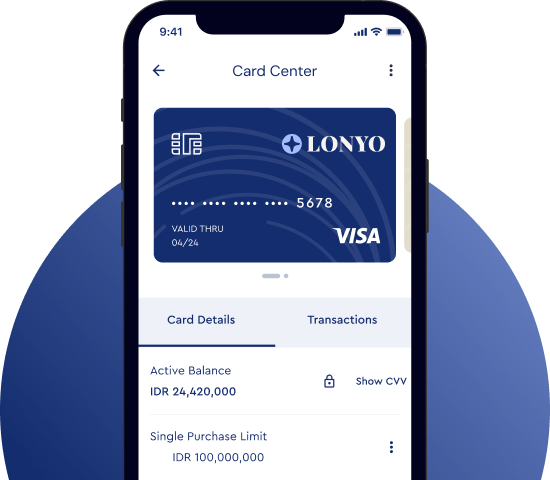

- 1. Connect Your Accounts: Link your bank, credit cards, and other financial platforms via this tool to start syncing transactions directly into Lonyo.

- 2. Automate and Organize: Once connected, transactions are automatically categorized, budgets are updated, and financial reports are generated without the need for manual input.

- 3. Track & Analyze: Use the finance software to monitor your finances, set goals, and track performance. You’ll also receive automated alerts and reminders to stay on top of your bills and spending.

- Integrating any tool with Lonyo is quick and easy. Start today and take control of your finances with automation.

This tool simplifies your spending and saving to organize your money.

Main pages

Utility pages

Join our newsletter

© Copyright 2025, All Rights Reserved by Mthemeus